Nearly 90% of Global Connected Car Sales will equip with 5G connections by 2030

Published: 5.7.2024

Counterpoint's latest report predicts that by 2030, nearly 100% of globally sold cars will be equipped with embedded connectivity, with two out of every three cars already having embedded connectivity. It is expected that between 2024 and 2030, the cumulative sales of 5G embedded cars will account for nearly half of the total sales of connected cars.

The automotive industry is ripe for disruption with the integration of various advanced features, from electric powertrain systems and AI-driven autonomous driving to advanced human-machine interfaces, real-time HD maps, and infotainment systems. All these features require active, stable, low-latency, and high-bandwidth cellular connections, where 5G comes into play, adding another technological dimension to integrate these features.

4G has been the primary cellular connection embedded in cars over the past decade through NAD modules, focusing on remote information processing, safety, and emergency call use cases. However, this new generation of automotive use cases rolled out in the next decade will require 5G connectivity to meet new advanced mobility use cases.

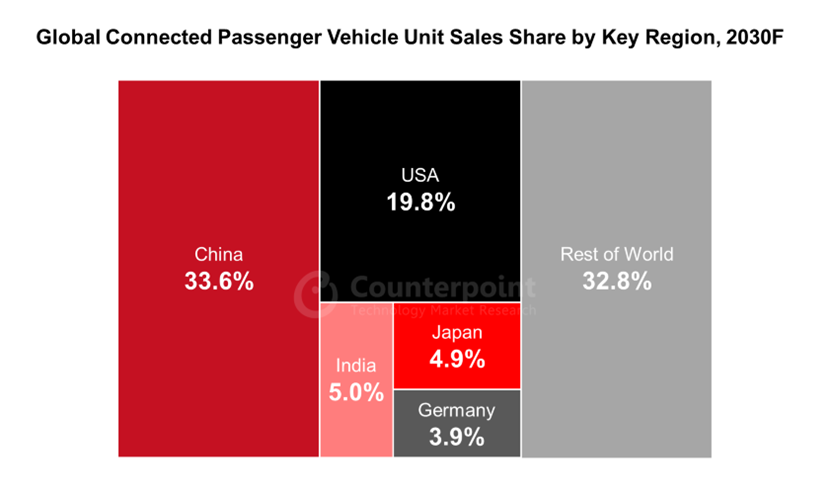

Currently, Germany leads in the penetration rate of connectivity, but China is expected to achieve 100% connectivity penetration by 2028, followed closely by the United States, India, Japan, and Germany. By 2030, the connected car sales in these five countries are expected to account for more than two-thirds of global connected car sales.

Source: Counterpoint Research Global Connected Car Forecast

Source: Counterpoint Research Global Connected Car Forecast

Analysts at Counterpoint state that China is expected to dominate the connected car market due to the rapid adoption of electric vehicles, C-V2X, and other interconnected infotainment functions. Domestic electric vehicle manufacturers such as BYD, NIO, XPeng Motors, and Li Auto are striving to differentiate their products from traditional manufacturers and expand into international markets.

In the United States, the second-largest connected car market globally, growth will primarily result from the adoption of advanced safety features such as V2X communication and Level 2+ autonomous driving. Leading telecom companies like AT&T are leading the way in the connected car field, while competitors like Verizon and T-Mobile focus on leveraging revenue opportunities through predictive maintenance, service scheduling, remote diagnostics, real-time mapping, and content platforms.

Between 2023 and 2030, India is projected to experience the fastest growth in connected car sales. Indian automakers are gradually closing the gap with their international counterparts and improving their digital products to enhance the driving experience.

Currently, over 96% of connected cars are powered by 4G, with 5G still in its growth phase. The high cost of 5G remote information processing equipment, lack of 5G infrastructure, and absence of compelling use cases are the primary reasons for 5G's slow growth in the early 21st century.

However, with the expansion of 5G coverage and the introduction of L3+ ADAS, 5G applications in connected cars are expected to rapidly gain popularity in the next decade. The 5G RedCap, slated for launch in 2026, will also be implemented in low-end cars, accelerating mass market adoption. It is predicted that by 2030, nearly 90% of cars sold will be equipped with 5G connectivity.

.png)